Interview with Anna Borschchevskaya, Senior Fellow, The Washington Institute for Near East Policy, USA, by di Dimitri Loringett

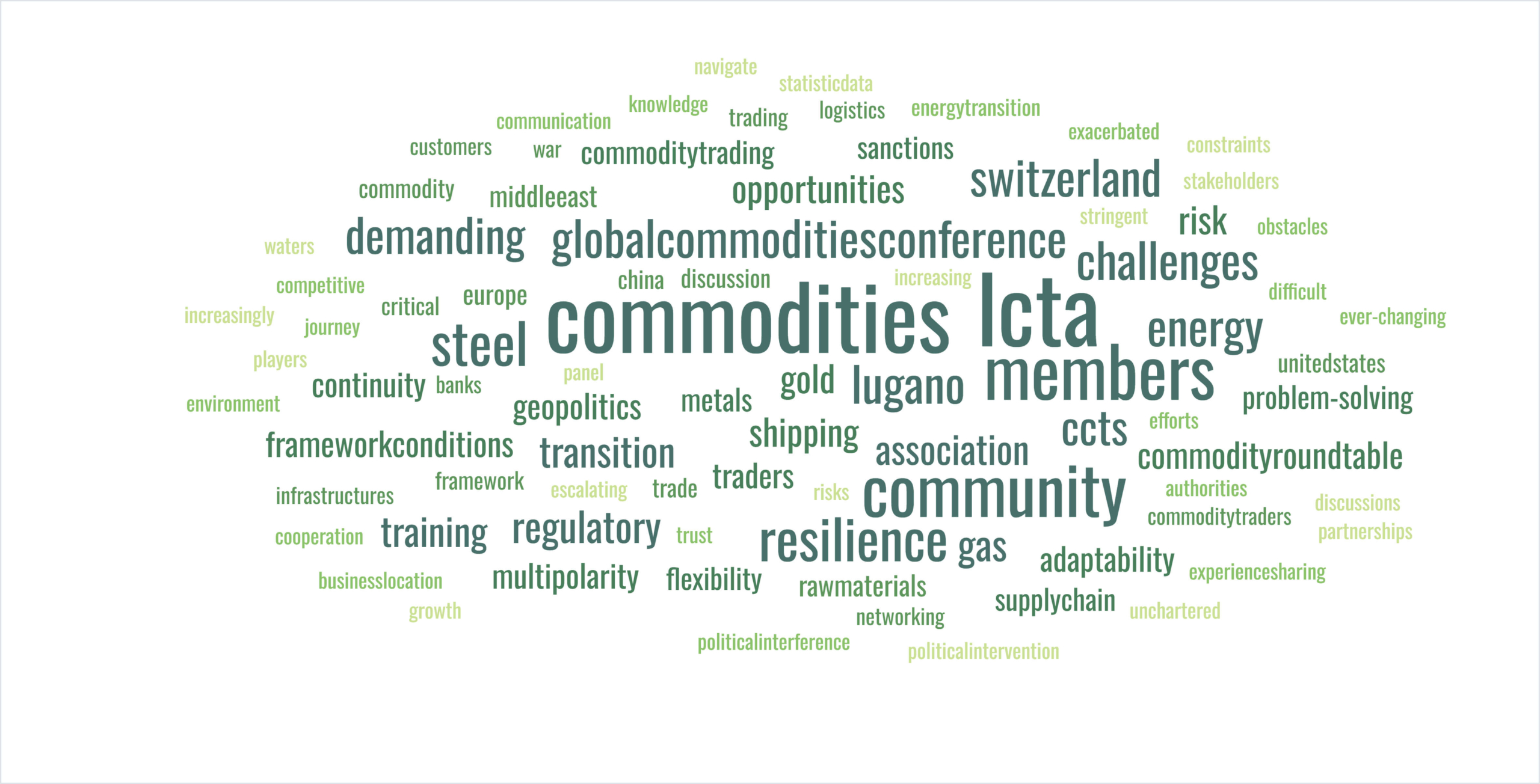

The Middle East’s strategic location between Europe, Asia and Africa makes it an important hub for global trade, particularly maritime transportation. The continuation of Israel’s war against Hamas in Gaza, as well as the dreaded conflict with Hezbollah in Lebanon, are a major concern also for the commodity trading industry in Ticino, represented by the Lugano Commodity Trading Association. In anticipation of the Global Commodities Conference, which will take place at LAC on July 2, we spoke with foreign policy expert Anna Borschchevskaya, who specializes on Russia and its role in the Middle East.

Part of the Lugano conference is dedicated to the Middle East, where the outbreak of the war in Gaza made the world of global trade jittery about the possible consequences of another crisis situation. Which ones, specifically?

«Overall, the region is going through a lot of turbulence. That is unlikely to change anytime soon, so it’s important to prepare for long-term disruption. This region sits at strategic nodes that impact maritime trade. Consider how the Yemeni Houthi rebels in the Red Sea utilize “cheap” drones to force the US to retaliate with more expensive weaponry. Other opponents of the West are likely to follow the Houthis’ example and discover ways to disrupt marine trade at low cost to achieve their own strategic objectives, which likely includes more disruptions to weaken the US and its allies.

Russia for its part is also involved in the region, and Russia’s so-called ghost fleet continues to deliver oil through these waters, but at far greater risk. For one thing the ghost fleet has no indemnification insurance, so the risk is simply higher when dealing with these ships».

The U.S. is called upon, and expected, to ‘fix’ the very complex and fragile situation in the M.E., but its long-standing influence and role as the ‘world police’ is (arguably) waning. On the other hand, there are also interests in the M.E. of other global powers, namely Russia which, however, is not involved in the ceasefire negotiations. Could Moscow do more (or anything) to ease tensions?

«Whether US influence is waning or not, Putin wants to remake the world order by enhancing Russian power and influence to weaken the West. Russia has always seen the Middle East as an arena of competition with the West. Moscow’s military intervention in Syria in late 2015 was a challenge to the liberal world order. Russia wants to see a multipolar world Moscow has used this region to achieve this aim. Russia for years had positioned itself as a mediator in the region, someone who can talk to all sides. But in reality, they always leaned closer to anti-American forces in the region, namely Iran and its proxies along with the Assad regime. Russia’s response to October 7 however has marked a break with this approach—Putin has demonstrated in clearest terms that he’s no friend of Israel. He did not directly condemn Hamas even as Russia’s own citizens were killed. Instead, Putin blamed the US the region’s problems. Russia also used the resultant chaos in the region to its advantage and worked to further exacerbate it because it benefits from this chaos on multiple fronts. Certainly, it had taken the West’s attention away from Ukraine. Russia was also bitter about ongoing Arab normalization efforts with Israel, because it was negotiated by the US. Russia was happy to see this agreement put in jeopardy and worked to exacerbate anti-Israeli sentiment in the Arab world. It’s hard to see what positive role Russia can play to contribute to solving the Israeli-Palestinian war. Given Russia’s October 7 response, it is unlikely that Israel sees Moscow as a neutral mediator, but the purpose of any Russian mediation is not to come up with a genuine resolution. It has no ability nor desire to bring forth a genuine resolution».

Iran is the declared archenemy of Israel and it is also a strategic ally of Russia. What does this alliance mean for the (in)stability in the Middle and Near East region?

«Russia benefits from perpetuated low-level conflict instead. For the first time in the Russia-Iran history, Russia now finds itself reliant on Iran, specifically on Iranian drones, which it deploys to hit Ukrainian targets. This means that the strategic partnership with Iran is not only going to deepen, but Russia will be likely to go further in terms of what it offers to Iran than it would have prior to the invasion of Ukraine. This means that together Russia and Iran are likely to cooperate more to exacerbate tensions and chaos in the region, to the detriment of Western interests».

How high is the risk of a war spreading to the Persian/Arabian Gulf?

«War is destabilizing no matter what. So while there is always a risk, a country usually would prefer to limit war. This is true, generally speaking, even of Russia’s war on Ukraine, at the time of this writing at least. Russia would prefer not to fight a direct war with NATO or the US for instance.

As for Iran, it doesn’t seem that Tehran wants to see wide-scale war. Certainly, it would want to see continual conflict, but it is easier to maintain this conflict from full-scale war. And Russia would prefer that also. Russia for its part wouldn’t want to be put in a position where it would need to overcommit resources it needs to fight the war in Ukraine».

Beyond the propaganda and allegations from the West, how real is the threat of Russia extending its military action beyond Crimea and the other eastern Ukraine territories it has occupied?

«First, let me say that it is Russian officials themselves that have made it clear that their ultimate aims go beyond Ukraine. Their destabilizing activities in Moldova, Georgia, and towards NATO members also raise legitimate concerns. Unofficially, Belarus has been involved for a long time. Their nuclear threats are also designed to deter the West from further action. Putin also casts the war as an existential battle where the West supposedly attacked Russia using Ukraine, so from the Kremlin’s perspective it is a global battle. It is certainly possible that if Putin feels that the war is going poorly, he may get more aggressive as part of escalation management, to move to other countries».

Is it truly in the best interest of the Western world to have Russia as an enemy?

«It is Russia that sees the West as the enemy. The West, to the contrary, for years had taken steps to integrate Russia, to address its concerns, and closed its eyes to its aggressive behavior. To give a few examples, NATO had set up a special Russia-NATO Council precisely to include Russia in discussion about NATO enlargement. Putin for his part never paid a price for his aggression, from Georgia in 2008, to Crimea in 2014, to Syria in 2015. These steps led him to conclude that the West is weak and would not oppose further aggression. Putin has been fighting a war with the West for years. It was not a direct conventional war, but a war nonetheless. It has taken the invasion of Ukraine for the West to begin to acknowledge that, and to begin re-evaluate its fundamental assumptions about Russia».

Is it safe to say that once the fighting will have stopped, and whatever the outcome of the conflict (which, as many analysts increasingly claim will bear neither a winner nor a loser), that the West-East divide is so deep that it will take at least a generation to change the narrative and regain trust between the two blocks?

«Russia has never come to terms with Holodomor (the man-made famine in Ukraine that caused several million deaths from 1932 to 1933, ed.). What we know from history of World War II is how difficult it is to get a country to come to terms with perpetrating a genocide. In Germany’s case it took not only losing the war but many years of American occupation. We don’t know how the war is going to end and when, but it is safe to assume that until Russia has a true internal reckoning with its past, it will take a lot more than a generation to overcome this enormous divide».

Article first published in the newspaper Corriere del Ticino, 28.06.2024 (in Italian)