On November 16 2019 at the Palazzo dei Congressi in Lugano was held the diplomas ceremony of the fifth edition of the CAS Commodity Professional, a training organized by the Lugano Commodity Trading Association (LCTA), in collaboration with the Zug Commodity Association (ZCA) and the Hochschule of Lucerne. The lessons were held alternately in Lugano and Zug and were able to provide the students with a global vision of the commodity trading and the tools needed to work in this sector. The president of LCTA, Thomas Patrick, the president of ZCA, Martin Fasser, LCTA Secretary General Marco Passalia and ZCA Secretary Martin Spillmann attended the ceremony. Congratulations to the students! Next course will start on May 2020.

Contribution by Ernst & Young.

Following the adoption of the Federal Act on Tax Reform and AHV (Old-Age and Survivors Insurance) Financing (TRAF) by popular vote in May 2019, all Swiss cantons are required to align their cantonal tax laws and ensure conformity with TRAF-regulations. Since the new measures are not all mandatory, the cantons have some discretion when adopting the new regulations, depending on the cantonal requirements and interest.

The Ticino Cantonal Government presented its proposal on how to implement TRAF in Ticino in a press conference on 10 July 2019. The new rules will enter into force as of January 2020, so planning for the change, based on the details that are published, is finally possible.

Mandatory Measures

Abolishment of preferential tax regimes

Like all other cantons, Ticino must abolish tax privileges for holding companies, domicile companies and mixed companies. In 2016, only 3.7% of all taxpayers were taxed according to a preferential tax regime. However, these companies contributed over 20% of the annual tax revenue generated by legal entities (CHF 144 Mio.) and are important for Ticino. Therefore, the Ticino Government is proposing a set of internationally accepted measures to replace certain tax regimes and to maintain the attractiveness of the Canton from a tax perspective.

Disclosure of hidden reserves

The abolishment of preferential tax regimes would result in the ordinary taxation of hidden reserves that were generated during the time that the privileged taxation applied. To mitigate this effect, cantons are required to introduce transitional rules. For that purpose, the so-called “two-rate system” will be introduced. Hidden reserves, including any self-created goodwill, at the date of transition from privileged to ordinary taxation, can be confirmed by the tax authorities upon request. Profits relating to the realization of hidden reserves that were generated under a privileged tax regime are subject to a separate tax rate over a period of 5 years. Ticino plans to apply a competitive tax rate of 1% to these profits. At the same time, the current step-up practice, set out in circular letter 29/2017, will be abolished from 2020. This means that the two-rate system will also be applied to companies that disclosed hidden reserves under the circular in the past.

Since trading companies often benefitted from a special tax regime, this measure is essential for them. It is important to start analyzing the opportunities presented by the transitional rules by evaluating the various scenarios. The different options for application of the transitional rules may present different benefit outcomes for a company. Amongst others, aspects to be considered include timing, valuation method, and the application of other available measures. EY has developed a comprehensive tool to simulate potential outcomes based on a variety of different scenarios and parameters. Using this tool, we are able to assist in identifying the most beneficial option.

In the case of a migration to Switzerland, the so-called step-up system is applied. Hidden reserves, confirmed by the tax authorities, can be tax effectively depreciated. According to the Ticino Cantonal Government proposal, the tax-free disclosed hidden reserves can be depreciated annually over a period of 10 years.

Patent box

According to federal legislation, all cantons must introduce a so-called “patent box”. This measure provides tax relief of a maximum of 90% of the income derived from patents and similar rights at cantonal and communal level. Ticino plans to make full use of this measure by introducing the maximum relief of 90%. However, as trading companies are typically not patent owners, this measure is unlikely to be too relevant for trading companies.

Overall tax relief

The Canton of Ticino intends to introduce a maximum tax relief of 70%. This is a very positive development, as a lower relief limitation was previously planned. With the 70% limit, the Canton of Ticino reaches the maximum possible tax relief in order to maintain the attractiveness compared to other Swiss cantons.

Optional measures

Capital tax relief

Companies with a preferential tax regime usually benefit from a reduced capital tax rate, which is often the case for trading companies. To mitigate the increase from the reduced capital tax rate when moving to ordinary taxation, the cantons can introduce a capital tax relief on patents and similar rights, qualifying participations, and intra-group loans.

Since 2018, a capital tax relief on qualifying participations has been available in Ticino. In addition, the Government has proposed to introduce capital tax relief on qualifying patents and similar rights. Regarding intra-group loans, the Government has decided (at this stage) not to implement a specific deduction. However, such a measure may still be introduced in a second step should this be necessary.

The change from privileged to ordinary taxation generally results in a significant increase of a trading company’s capital tax burden. Such increase might be mitigated in case a company can apply for additional tax relief that will be introduced for capital tax purposes.

R&D super deduction

The reform allows for the introduction of a super deduction on domestic R&D costs at the cantonal level. This measure aims at promoting R&D activities. Cantons may allow the deduction of up to 50% of qualifying R&D costs from the taxable income. In order to promote and develop R&D activities in its territory, the Ticino Cantonal Government has decided to propose the maximum deduction rate of 50%. This measure should have little impact for trading companies as they are typically not carrying out R&D activities in Switzerland.

Notional interest deduction (NID) on surplus equity

The notional interest deduction (NID) is basically granted on equity which, in the long-term, exceeds the average equity required for business operations. It is a measure only intended for application in “high-tax” cantons so will not be implemented in Ticino as Ticino does not fall under the definition of a high-tax canton.

Additional measures

In addition to the mandatory and optional measures outlined above, the canton of Ticino has decided to implement further corporate tax measures.

Reduction of cantonal tax rate and cantonal multiplier

In order to maintain the tax attractiveness of Ticino, the corporate tax rate will be gradually decreased from 9% today to 8% in future for the period 2020 to 2024. From 2025 onwards, the rate will be further reduced to 5.5%. The cantonal multiplier will be reduced from 100% today to 98% for the period 2020 to 2024. From 2025 onwards, it will be further reduced to 96%.

These measures should lead to a future envisaged ETR of approx. 13.7% in the most attractive communes, which should allow the current tax privileged companies to almost maintain their current taxation level.

Differentiated communal multiplier

Today the canton Ticino applies one multiplier for both individuals and legal entities. From 2025 onwards, communes will be entitled to introduce different communal multipliers. The different multipliers are subject to the following conditions: (i) the communal multiplier must not be below 40% for both individuals and legal entities, and (ii) the spread between the communal multiplier for individuals and legal entities must not exceed 20%.

Increased creditability of corporate income tax against capital tax

The creditability of corporate income tax towards capital tax will be increased from 10% to 16% (as from 2025).

Conclusion

Trading companies, currently benefitting from a privileged tax regime such as the mixed company regime, should carefully consider the potential risks and opportunities arising from the upcoming tax reform. In particular, the fact that the tax regimes will be abolished requires them to properly analyze the different options available under the transitional rules and other new measures to be implemented. Any review should include the quantification of the financial implications, taking into account a number of parameters including, but not limited to, financial forecasts, hidden reserves, and goodwill, together with the application of the various measures and relief limitations. To be effective, planning and implementation should be completed before the end of 2019. Therefore, we recommend you take action now.

Cover Image © Fabio Marchese – Unsplash

On June 13, 2019, members and friends of the Lugano Commodity Trading Association (LCTA) attended in large numbers the annual “Commodity Traders’ Dinner”, one of the most important event that the LCTA organises every year.

The event took place at the “Tenuta Bally von Teufenstein”, a prestigious location in the middle of the vineyards. The evening program included a conference, focused on current hot topics, and was followed by a networking standing dinner. It was a great opportunity to meet in the area of Lugano commodity traders as well as representatives of banks, insurances, fiduciaries, shipping companies and other services providers.

The President of the LCTA, Thomas Patrick, held the opening speech. Then Alexander Galilov (Filhet-Allard Maritime, kind sponsor of the event) presented an interesting overview on their activities in Switzerland and abroad.

The special guest of the event, Ramon Esteve – President of the Swiss Trading & Shipping Association (STSA) – gave a speech on the goals and challenges of the national association, which includes also the regional organisations as LCTA and ZCA. STSA’s expertise is largely recognised and the association plays a very important role. It is a strong association and it aims at reinforcing local presence to increase national weight.

A very interesting part of the conference was the presentation of the Swiss Federal Council Report “The Swiss commodities sector: current situation and outlook” (November 2018) by Frédéric Chenais (FDFA), Nina Taillard(EAER), and Julie Tomka (FDF). The report underlines that Switzerland is still a leading global commodities trading hub and an attractive location, despite the difficulties (under constant pressure given the attractiveness of other trading centres). The report expresses two main recommendations that aim at:

- maintaining Switzerland’s prominent position as a competitive and socially and environmentally responsible trading centre and to sustainably secure the significant contributions in added value that the commodity companies make to Switzerland’s overall economy

- ensuring that overall political, economic and legal conditions make Switzerland an attractive and reliable location for doing business in all sectors, including the commodities industry

The audience had also the opportunity to receive more information about the “Guidance on Implementing the UN Guiding Principles on Business and Human Rights”, the result of a public consultation with NGOs, the private sector and the Geneva cantonal authorities.

In conclusion of the event, Barbara Engeli of the Aarambh Joyti Association presented an important humanitarian project for a hospital construction in Bihar, India.

Contribution by Ernst & Young.

On 19 May 2019, in a popular vote, Switzerland approved the Federal Act on Tax Reform and AHV (Old-Age and Survivors Insurance) Financing (TRAF) as adopted by the Federal Parliament last fall. The tax reform’s objectives include: (i) securing the long-term tax attractiveness of Switzerland as a business location; (ii) restoring international acceptance of the Swiss tax system; and (iii) securing an appropriate level of tax revenue. The tax reform brings the replacement of certain preferential tax regimes with a new set of internationally accepted measures. The legislative changes align with the broad reduction of the cantonal corporate tax rates.

The last proposed tax reform with the same aim – Corporate Tax Reform III – was rejected by the Swiss voters at the beginning of 2017. Since the need for tax reform was undisputed, the Federal Council immediately drew up a new proposal. Based on the rejection of Corporate Tax Reform III, TRAF was combined with additional AHV financing as a form of socio-political compensation.

Core tax measures

Abolishment of preferential tax regimes

At the cantonal level, tax privileges for holding companies, domicile companies and mixed companies are terminated. At the federal level, the profit allocation rules for principal companies and Swiss finance branches no longer apply.

Tax-free disclosure of hidden reserves

Hidden reserves including any self-created goodwill at the point in time of transition from privileged to ordinary taxation or migration to Switzerland are confirmed by the tax authorities. In the case of a migration to Switzerland, the so called step-up system is applied. The tax-free disclosed hidden reserves are to be depreciated annually at the rate applied for tax purposes to the respective assets. In the case of a transition, the so-called two-rate system is applied. Profits relating to the realization of hidden reserves that were generated under a (now abolished) privileged tax regime are subject to a separate tax rate. The cantons are free to determine the amount of this special tax rate. The two-rate system ensures a competitive income tax burden during a five-year transition period. It should be noted that taxpayers may revoke voluntarily their tax privileged status before the reform enters into force (so-called early transition). Depending on the transitional regulations offered by the cantons, this may be a beneficial option.

Patent box with a maximum relief of 90%, mandatory at the cantonal level

A core element of the reform is the introduction of a patent box regime in accordance with the Organisation for Economic Co-operation and Development standard. In the box, net profits from domestic and foreign patents and similar rights are to be taxed separately with a maximum reduction of 90% (rate at cantonal discretion).

R&D super deduction of maximum 50%, optional at cantonal level

The introduction of this super deduction for domestic R&D is Switzerland’s commitment to be recognized as an attractive location for R&D. The maximum deduction of 50% (rate at cantonal discretion) is limited to personnel expenses for R&D plus a flat-rate surcharge of 35% for other costs and 80% of expenses for domestic R&D carried out by third parties or group companies.

Notional interest deduction (NID), optional at cantonal level

So-called high-tax cantons have the possibility of introducing a NID on excess capital. According to the currently published intentions of the cantonal governments regarding tax rate developments, only the canton of Zurich meets the requirements.

Overall tax relief of 70%, mandatory at the cantonal level

The patent box, R&D super deduction, and NID as well as possible depreciations from the early transition from privileged to ordinary taxation are subject to the overall tax relief of 70%.

Additional measures

Adjustments in taxation of dividend income from qualifying participations

Dividend income of individuals from qualifying participations is currently partially exempt from taxation to mitigate double taxation at the shareholder level. At the federal level, the taxation rate increases from 50% (business investments) and 60% (private investments) respectively to a standard rate of 70%. At the cantonal level, there is a harmonization of the relief method and an introduction of a minimum taxation rate of 50% (rate at discretion of cantons).

Capital tax relief, optional at the cantonal level

Privileged taxed companies usually benefit from a low capital tax rate. To compensate for the loss of this tax advantage, the cantons are given the possibility to reduce the taxable capital on patents and similar rights, qualifying participations and intra-group loans to also remain competitive from this angle.

Adjustments of the capital contribution principle

Swiss-listed companies may only pay tax-free capital contribution reserves if they pay taxable dividends in the same amount. Intra-group dividends and capital contribution reserves from assets transferred from abroad after 24 February 2008 and in the case of a liquidation are not affected by this scheme. The above rules shall also apply to the issue of bonus shares and nominal value increases from capital contribution reserves.

Extension of the flat-rate tax credits on foreign companies’ permanent establishments

To prevent international double taxation, Swiss permanent establishments of foreign companies should be able to claim withholding taxes on income from third countries with a flat-rate tax credit.

Social compensation via the AHV (Old-Age and Survivors Insurance)

It is assumed that the loss of tax receipts due to the tax reform will amount to CHF2b (in a static view). This shortfall will be compensated through the AHV: (i) 0.3% increase in salary contributions (employers and employees one half each); (ii) allocation of the federal share of the demographic percentage of value added tax to the AHV; (iii) increase in the federal contribution to the AHV from currently 19.55% to 20.2%.

Reduction of cantonal profit tax rates

The reduction of cantonal profit tax rates is not directly covered by TRAF but is necessary to remain attractive from a tax perspective for former tax privileged companies and thus a key part of the proposed tax reform. The increase of the canton’s share of the federal direct tax from 17% to 21.2% enables the cantons to reduce their tax rates.

Based on official announcements made by the cantonal governments, it is expected that the majority of the Swiss cantons will provide attractive tax rates on pre-tax income between 12% and 14% (including federal tax).

Implications

The tax reform measures will enter into force as of 1 January 2020. The tax reform achieves its main goal of retaining Switzerland’s international attractiveness while having an internationally accepted tax system. The tight time frame requires prompt planning from taxpayers regarding the transition to the new regulations.

The reform represents the greatest change in the Swiss corporate tax system in decades and affects essentially all enterprises in Switzerland. Analysis has to be undertaken within the next few months to properly adjust to the new tax landscape and to avoid a competitive disadvantage.

Cover Image © Seb Mooze – Unsplash

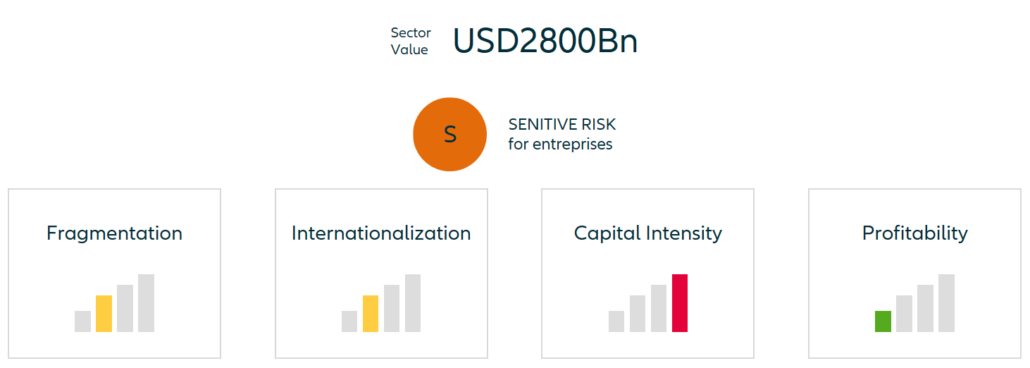

Contribution by Euler Hermes.

What to Watch?

- Global trade momentum and political intervention

- Indications of demand strength, particularly in China, but also in construction and automotive

- Management of overcapacities

As a whole, after a weak 2018, the outlook for the metals sectors is mixed. Economic trade uncertainty has compounded the problem of slowing metal-consuming industries. Metals is one of the most exposed sectors as far as the impact of protectionism is concerned.

Steel demand growth will weaken considerably as a result of a slowing economy and uncertainties over trade. While there is still growth in the automotive sector, its reduced rate will weigh negatively. At the same time, the outlook for construction, one of the most important end markets, remains mixed despite moderate growth in a number of large markets. Strength from the machinery sector is unlikely to outweigh that.

The World Steel Association forecasts 1.4% y/y growth for 2019, compared to 3.9% demand growth for 2018. Chinese demand is expected to be flat.

Steel prices continue to reflect overcapacity, while iron ore prices pressure margins. Earnings are still being revised downwards. The current consensus stands at a 14% y/y earnings decline.

Aluminium also presents a patchy picture. There is a risk that the Chinese aluminium market might flip into excess capacity as capacity gets commissioned in despite curbs and Russian producers see sanctions eased. The sector should see demand growth in the order of 3%, according to guidance by some of the major producers for 2019, with aerospace a positive driver. There is potential for a global production deficit, also due to production outages. Yet, margins are tight because of raw material prices, and the scope for aluminium price recovery appears limited.

Copper will to a great degree depend on the success of Chinese stimulus measures. An increase in supply may curb price increases, though, and balance the market. Further USD appreciation will have a negative impact on all metal prices. Margins are likely to compress in the mining sector, due to weak prices, to the tune of 300bps at Ebitda level on 12% y/y revenue decline in 2019 according to current consensus (source for all consensus data: Bloomberg). Nevertheless, the sector is cash generative, and with net debt standing below 1.0 on average for the global peers, they should be able to deploy such cash into incremental capex, in the order of 5-8%, chiefly going into equipment replacement.

Iron ore: A correction is likely after prices have come off a peak in early 2019 and the demand outlook is patchy.

Steel companies: Global overcapacity but the high level of import taxes protects some specific markets such as US and Canada.

Nonferrous: The sector is cash rich on the back of strong prices. The LME Index has risen 17% in 2018.

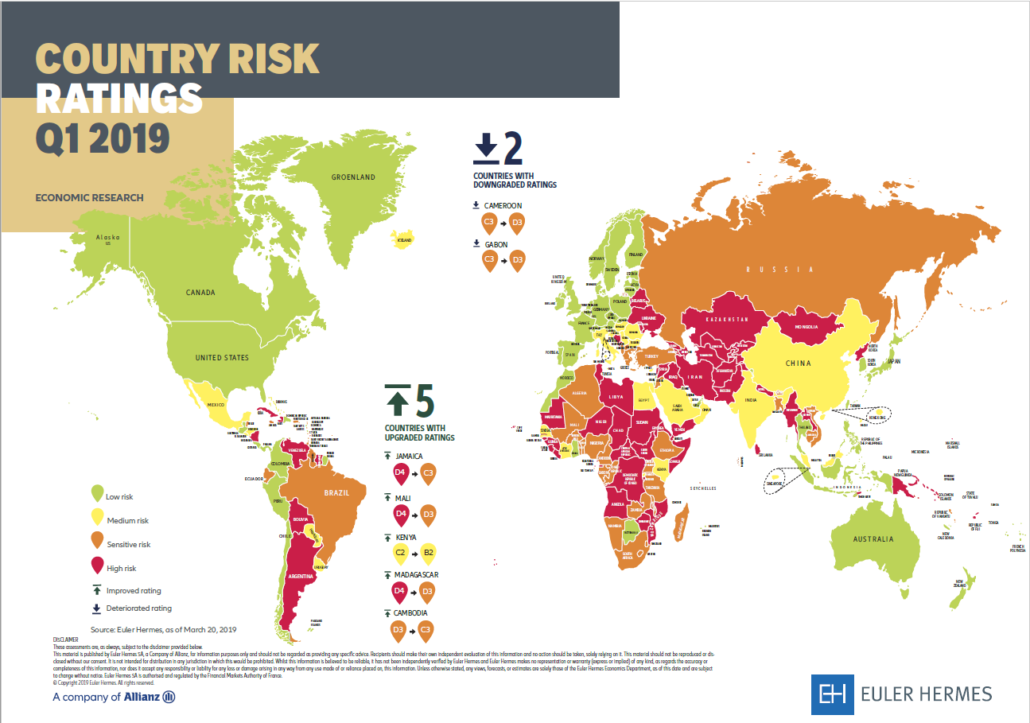

Get our Country Risk Map here

Marco Arrighini

Senior Sales Manager

Euler Hermes Switzerland | Via A. Adamini 10A | CH-6900 Lugano | Switzerland

marco.arrighini@eulerhermes.com

www.eulerhermes.ch

t +41 91 922 73 64

m +41 79 501 43 44

Contribution by KPMG.

Federal vote

On 19 May 2019, the Swiss public will vote on the Federal Act on Tax Reform and AVS Financing (TRAF). The tax reform, which Parliament has linked to a social compensation measure concerning AVS financing (Old Age and Survivor’s Insurance), provides in particular for the abolition of internationally no longer accepted tax regimes and for the introduction of transitional and replacement measures. However, these measures have met with rejection in certain political camps. In addition, the combination with additional AVS financing has mobilized further opponents.

Background

Like its predecessor – the Corporate Tax Reform III (CTR III), rejected by public vote on 12 February 2017 – TRAF pursues the same three main objectives: to maintain the attractiveness of Switzerland as a business and tax location, to promote international acceptance of the Swiss corporate tax legislation and to ensure sufficient tax revenues to finance public activities. Therefore, some elements of the CTR III are still included in the new proposal. Other elements have been added subsequently in order to create a balanced reform that – hopefully – meet with acceptance.

The potential impact to commodity traders

The main measures that could have a relevant impact to the Commodity Traders is the abolition of status companies at Cantonal level (Mixed Company status). It is well established that Cantons usually granted the Mixed Company status to the Commodity traders (Art. 93 of the Ticino Tax Act, “società ausiliaria”), excluding part of the income generated abroad from Corporate Income Tax and allowing a lower taxation on equity.

The abolishment of cantonal tax statuses will lead to an increase of the applicable tax rate for companies that previously enjoyed privileged tax status. To prevent the shock, TRAF include a transitional measure and allow a smoother transition from the privileged to the ordinary taxation.

Disclosure of hidden reserves (step-up)

For companies changing status, transitional measures provide for two possibilities to prevent over-taxation of hidden reserves. The first, in accordance with current practice in most cantons, it to disclose tax-neutrally and subsequently depreciate existing hidden reserves when the status is abandoned (current law step-up; disclosure solution). The second is application of a special tax rate (special tax rate solution).

Current law step-up (disclosure solution)

The current law step-up allows companies to effectively disclose hidden reserves formed, or self-generated value created (goodwill), under a privileged tax regime in the tax balance sheet immediately before the privileged status is abandoned. For this purpose, a taxed hidden reserve is disclosed in the tax balance sheet without the need to make a corresponding entry under commercial law. In the following tax periods, the taxed hidden reserve can be depreciated tax-effectively, taking into account the overall limitation of measures. (The depreciation period is defined according to cantonal regulations or depreciation rates published by the Swiss Federal Tax Administration, respectively).

Special tax rate solution

The special tax rate solution provides for separate taxation over five years of the portion of the profit based on the realization of hidden reserves and goodwill, which were previously not taxed under the old regime. The maximum amount is limited to such hidden reserves available at the time of the status change. The amount must be recorded in a decree. In contrast to the practice under the current law step-up, the special tax rate solution does not result in the disclosure of hidden reserves in the tax balance sheet. This eliminates the issue of recognizing deferred tax assets.

Outlook

In case of a Public’s “Yes” on 19 May 2019, it is planned that the reform will come into force on 1 January 2020. The regulation concerning a temporary special tax rate solution is to come into force immediately after the referendum vote. The cantons will thus be able to make use of this measure early in order to mitigate the de facto tax increase for those companies that plan to waive their cantonal tax status earlier in time.

In the event of rejection, the Federal Council would have to act quickly and ensure that the tax regimes criticized by the OECD and the EU are abolished – potentially together with increasing the cantonal share of federal tax revenue and adjusting the fiscal equalization system. Otherwise, it would hardly be possible to prevent Switzerland from being blacklisted by the EU.

Next steps

The local tax experts of KPMG would be glad to discuss the impact of TRAF and the potential relief of the transitional measures. Please contact KPMG Lugano to schedule a meeting with us.

Cover Image © Seb Mooze – Unsplash

Sono 16 i laureati della quarta edizione del CAS Commodity Professional, una formazione organizzata dalla Lugano Commodity Trading Association (LCTA), in collaborazione con la Zug Commodity Association (ZCA) e la Hochschule di Lucerna. Le lezioni si sono tenute in modo alternato a Lugano e a Zugo e hanno potuto fornire agli studenti una visione globale del settore delle materie prime e degli strumenti necessari per lavorare in questo ambito. Novià di quest’anno: un Modulo si è tenuto al passo del San Gottardo, Alla cerimonia, che ha avuto luogo presso la sala del Consiglio comunale di Lugano, sono intervenuti il presidente della LCTA, Thomas Patrick, il presidente della ZCA Martin Fasser, il segretario generale della LCTA Marco Passalia e il segretario della ZCA Martin Spillmann.

Fotografie © Loreta Daulte

Le problematiche attuali nel commercio internazionale, il Kazakistan come potenza per le commodities e centro finanziario euroasiatico. Questi gli argomenti principali trattati durante la serata di apertura della Commodity Trade Finance Conference, organizzata con successo dalla Lugano Commodity Trading Association (LCTA) in collaborazione con il gruppo londinese GTR Exporta Group. Oltre 200 persone hanno partecipato alla due giorni di incontri che ha riunito al Palazzo dei Congressi di Lugano i principali attori del settore del commercio di materie prime e del commercio internazionale.

Mercoledì 26 settembre, la conferenza “Current Issues in International Trade & Kazakhstan – Commodities Powerhouse and Eurasian Financial Hub”, organizzata dalla LCTA, ha attirato aziende locali e internazionali interessate ad approfondire queste tematiche. Ad aprire la serata – dopo il breve saluto iniziale del presidente della LCTA Thomas Patrick – una brillante intervista da parte di Pietro Poretti, Responsabile Divisione sviluppo economico, Città di Lugano, a Niall Meagher, Direttore esecutivo del Centro consultivo sul diritto dell’Organizzazione Mondiale del Commercio. Il confronto tariffario in corso sta agitando i mercati, creando volatilità e incertezza. Nonostante le molteplici minacce di ritorsioni, l’economia globale non sta cadendo nel caos. Essendo l’OMC l’unico strumento multilaterale che disciplina il commercio internazionale, si è cercato di rispondere alla domanda: può l’Organizzazione Mondiale del Commercio (OMC), ora nel suo secondo decennio di esistenza, forzare efficacemente i Governi affinché giochino secondo le regole?

Secondo momento saliente della serata è stato l’intervento di Temirlan Mukhanbetzhanov, Manging Director, Astana International Financial Centre (AIFC), il quale ha sottolineato il ruolo sempre più ponderante del Kazakistan come potenza per le commodities e centro finanziario della zona euroasiatica. I commercianti di merci conoscono il Kazakistan per le sue abbondanti riserve di combustibili fossili e vasti giacimenti di minerali e metalli tra cui uranio, zinco e rame. Nel 2018 il paese ha lanciato ufficialmente l’Astana International Financial Centre (AIFC). Con l’inglese come lingua principale e titoli di stato e diritto societario, l’AIFC incarna l’approccio riformista e lungimirante del governo kazako e mira a diventare il primo hub finanziario dell’Eurasia.

Giovedì 27 settembre si è tenuta la quinta edizione della “Commodity Trade Finance Conference” condotta da Marco Passalia, General Secretary – LCTA. Le tematiche centrali della conferenza sono stati le sfide, le opportunità e gli sviluppi che influenzano l’attuale mercato globale delle materie prime, affrontando le preoccupazioni in merito alle politiche commerciali protezionistiche e le “guerre commerciali”, il cambiamento delle aziende attive nel commercio di materie prime, gli sforzi per raggiungere una maggiore sostenibilità, l’emergere di nuove piattaforme di finanziamento e il rischio delle operazioni. L’attenzione è stata poi spostata sulle principali materie prime trattate dalla aziende ticinesi, ovvero metalli, carbone ma anche prodotti energetici (petroliferi, gas naturale e elettricità).

Una giornata molto intensa e ricca di spunti che anche quest’anno ha portato a Lugano ospiti da tutto il mondo. Una conferenza attesa dai traders ma anche dagli esperti del settore finanziario poiché dà l’opportunità, nel contesto dei diversi panel, di stabilire delle interessanti occasioni di networking e di conoscenze per poter sviluppare il proprio business.

Con lo slancio del successo della due giorni dedicata al settore delle commodities, la LCTA si prepara per la sesta edizione luganese della Commodity Trade Finance Conference nel 2019.

Commodity traders’ dinner on Lugano lake

On June 14, 2018, members and friends of the Lugano Commodity Trading Association (LCTA) attended in large numbers the annual “Commodity Traders’ Dinner”, one of the most important event that the LCTA organises in the year.

The first part of the event took place at the Convention Centre in Lugano and was followed by a networking dinner on Lugano Lake.

Sponsor of the event – Euler Hermes, our precious partner. Special guests of the evening were Gilbert Wright – Co-Founder and Managing Partner for Maritime & Commodity Services, LLC (MCS) and Marine Inspection, LLC (MIL) – and Lisa McGoey, the Executive Director of the Mississippi Valley Trade & Transport Council and has been since 2011. Mr. Wright has over 35 years’ experience in the international commodity inspection and shipping logistics industries and gave a speech on the overview of the Commodity Traffic & the Challenges along the Mississippi River. Mrs. McGoey has over 20 years’ experience in the maritime industry and transportation industry as a paralegal in several different law firms in the New Orleans area and presented the Mississippi Valley Trade & Transport Council. It was a great occasion to deepen different topics but also a unique opportunity to meet in the area of Lugano commodity traders as well as representatives of banks, insurances, fiduciaries, shipping companies and other services providers.

CAS Commodity Professional education opportunity in commodity trading

Study content

Commodity trading and related services have grown significant in the Swiss economy, and they are expanding even further. These companies are in search of talents.

In cooperation with the Lucerne University of Applied Sciences and Arts, the Lugano Commodity Trading Association (LCTA) and the Zug Commodity Association (ZCA) offer a certificate of advanced studies CAS for commodity professionals. The certificate programme will provide attendants with a thorough understanding of the commodity industry and its characteristics. The course work will provide students from the commodity sector with detailed skills, students from commodity service providers the ability to better understand their clients, and give all graduates tools to enhance their careers. The CAS Commodity Professional combines theoretical know-how with hands-on learning experience provided by accomplished guest speakers. This programme prepares the participants to take on management or specialist functions within the commodity industry.

- Basics of Commodity & Geopolitical Dynamics

- Commodities within the value chain

- Shipping and Transport

- Trade Finance

- Basics of Risk Management

- Legal Aspects and Compliance

Scholarship amount: CHF 7,900 (CAS tuition fee)

Application requirements:

To apply to the LCTA scholarship, applicants must fulfil the following criteria:

- Employee of a company, which is member of the LCTA

- Tertiary education (as minimum level)

- Good marks in the previous educations

- Multi language. In particular, good knowledge of the English language (fully taught in English)

- International skills

- Letter of reference from the employer or from a key-person in the commodity trading sector

The scholarship is granted if the following conditions are fulfilled:

- The student is required to have an 80% attendance at the lessons

- The student has to pass all the exams

- The student has to carry out a research on a topic related to the Lugano commodity trading hub (defined by the board of the LCTA)